Phrases like net zero plans and emissions offsetting are becoming increasingly part of the corporate lexicon. Nevertheless, the practical means for doing so remain difficult jungles to navigate, are subject to change, and often misunderstood. Given the importance of carbon markets to both Tree.ly’s mission and the future of the planet, here we offer the reader a (relatively) short introduction to the topic as of 2022.

First step: recording GHG emissions

While the focus of carbon markets is on offsetting – and offsetting is often the cheapest and most appealing option - it’s important to state that the initial focus of any net zero strategy should be avoiding and reducing greenhouse gas (GHG) emissions in the first place. A company’s unavoidable emissions can then be offset in an ever-growing number of ways (CDU, DAC, Tree.ly). But the first step in any carbon compensation strategy is to systematically record emissions (CO₂ and others) along the value chain.

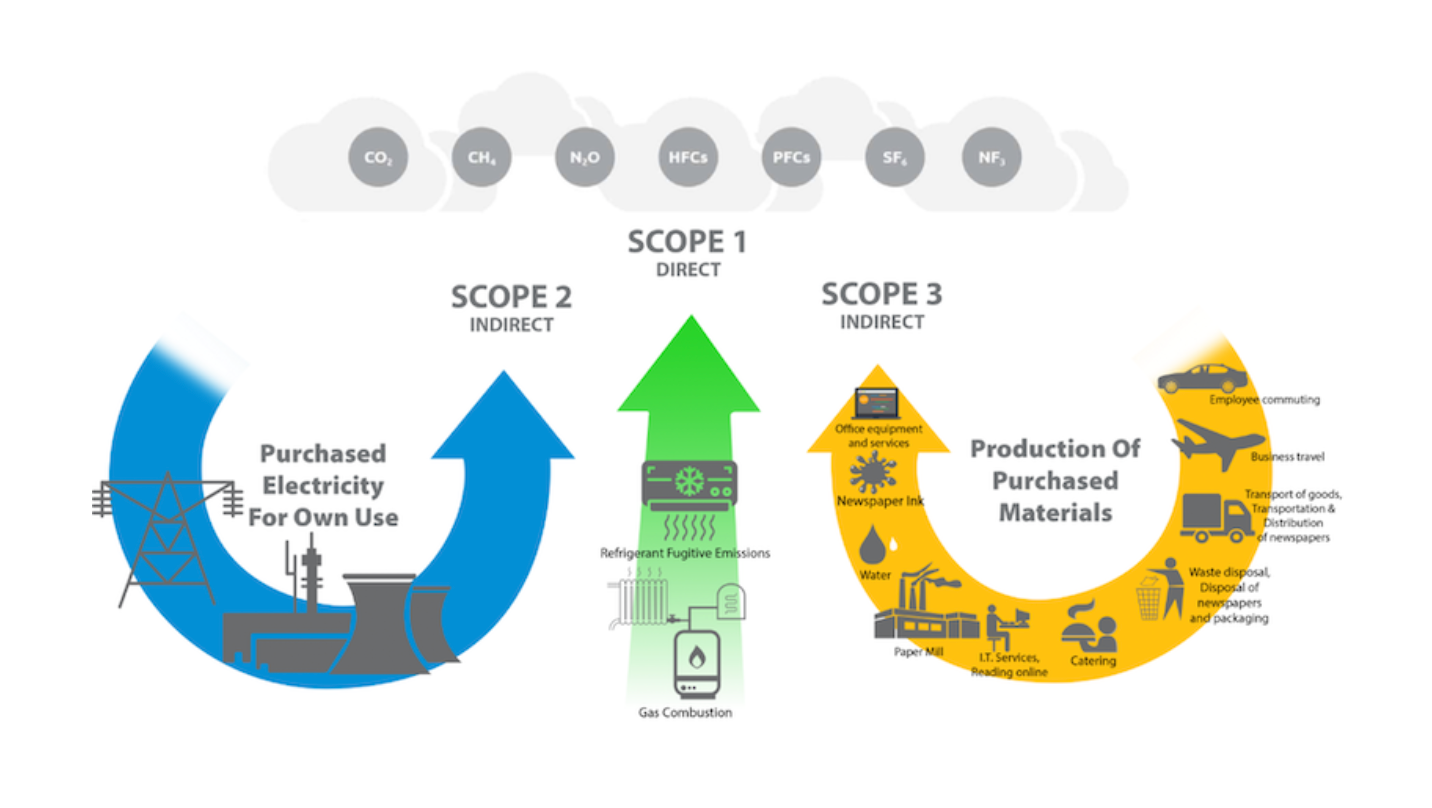

The GHG Protocol is the most widely used methodological framework for GHG accounting. Coordinated and developed by the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD), it defines three areas – Scope 1,2,3 - to which GHG emissions are assigned:

Source: www.greenelement.co.uk

Source: www.greenelement.co.uk

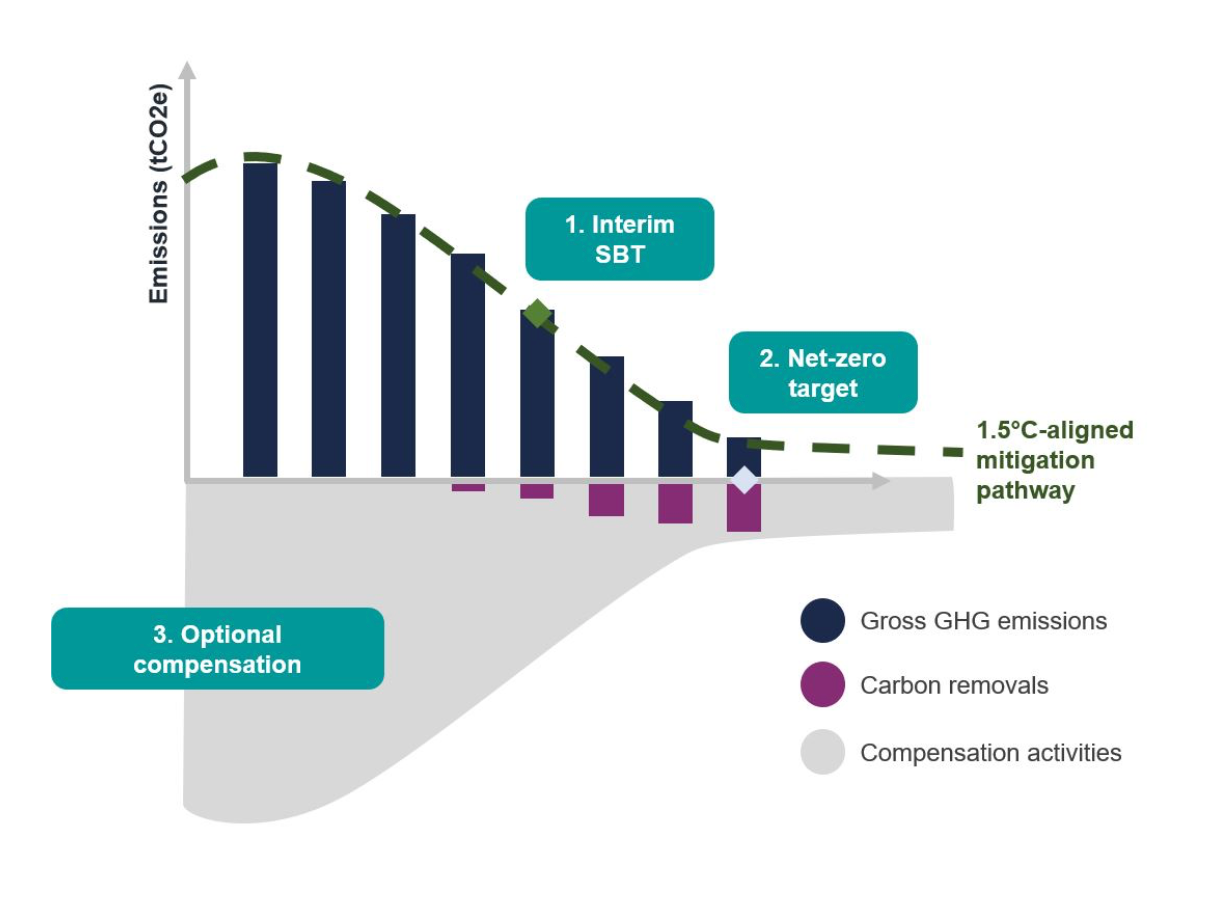

Once the GHG balance is established as a starting point, a company can set long-term reduction targets, target paths and timelines as part of a climate protection strategy. But for these to be meaningful, they must be science-based.

Science-based targets

The Science Based Targets initiative (SBTi) serves as an excellent guide, showing companies how to set reduction targets for achieving the Paris climate targets. These should include at least 95% of Scope 1 and 2 emissions. If more than 40 per cent of GHG emissions are in Scope 3, the SBTi recommends setting ambitious, measurable Scope 3 targets. Since double counting can occur when recording CO₂ emissions in the supply chain, double offsetting by several actors can also arise (more on this below). As there are currently no international regulations in this area, it is recommended to proceed carefully when selecting the recording and target-setting method.

Compensating based on SBTi

Although offsetting does not help reduce a company's own emissions, it does contribute to achieving net zero emissions outside the company's value chain. Because of this beneficial effect, SBTi calls this approach "climate positive". There are two options here: full offsetting or partial offsetting.

Full offsetting: Companies pursue their target path by avoiding and reducing emissions. In this way, companies achieve net zero emissions in the target year, i.e. all emissions along the path are offset by the target year.

Partial offsetting: Here only the difference (the delta) between the actual and the target emissions is offset. The residual emissions of the target path are not offset.

On Additionality, Vulnerability and Permanence

Let’s break down three important terms when it comes to implementing meaningful compensation strategies: Additionality: Climate protection measures from offset projects must be of an additional nature, meaning they come from projects that would not have been initiated without the offset funding. Vulnerability: The oversupply of certificates and the question of which of the already running projects are dependent on the income from the sale of certificates raises the question of vulnerability. Vulnerable climate protection projects run the risk of not being able to continue emission reductions if the income from the certificates is lost (see more in the research from DEHSt). Permanence: Emission savings through climate protection projects must be permanent - the greenhouse gases saved must not be released back into the atmosphere.

Project quality and requirements

The quality of climate protection projects is crucial. High-quality and costly projects with high benefits are more likely to be transferred to the new Article G regime under the Paris Agreement. It should be noted that there are many cheap certificates on the market. Low-cost certificates can originate from projects carried out even without the additional income from the sale of the certificates, hence not actually helping to reduce emissions. Such measures therefore do not compensate for emissions caused by a company.

Project quality is therefore paramount. This is where Tree.ly’s high-quality projects in European forests really stand out, with every element and stage of a project mapped out in detail – check out our portfolio.

Double counting

Double counting of a unit of saved CO₂ occurs when two actors count the same tonne of CO₂ saved. Example: in a project in India, 1 tonne of CO₂ is avoided; this tonne of CO₂ could now compensate for the emissions of a German company. But India as a country could also claim the saving for its NDC. There is not only a theoretical conflict here, because two parties - the German company and India - claim the same physical tonne of CO₂ reduction.

The Paris Agreement has laid out rules to deal with double counting, which are currently being negotiated.

For carbon certificates issued for Tree.ly projects, this issue of double counting is fundamentally avoided.

Carbon markets: Pitfalls to avoid

Whichever approach companies choose, there are a few common pitfalls to avoid. This includes purchasing certificates from projects of poor quality, such as lack of additionality or permanence (see above definitions). Such allowances cannot be used for offsetting, even if the associated emission reductions were achieved before the end of 2020.

Certificates from unidentifiable projects should also be avoided - companies should ensure they have direct access to all primary project information. Lastly, it should be clear to a company how funds are used and what their money is spent on.

For each of these pitfalls, Tree.ly projects offer significant advantages, with complete transparency and accuracy, coupled with the fact that any money generated is transparently reinvested back into forest projects.

Find out more about purchasing carbon credits from verified forest projects right here in Europe, enabling sustainable action in your own backyard: https://tree.ly/carbon-buyers